ARTICLE AD BOX

PA Media

PA Media

Chancellor Rachel Reeves at the Rolls-Royce factory in Derby after growth figures were announced

It's not a boom, but it is something to be roundly welcomed.

Today's economic figures may reflect erratic trade war factors, and bounceback from stagnation at the end of last year.

The growth may prove short lived if the gravitational pull of US tariffs and tax rises do hit hard.

The valid caveats, should not, however, get in the way of the main story here.

The UK economy did far better than doom-laden predictions for the first three months of this year.

It was nowhere near a recession.

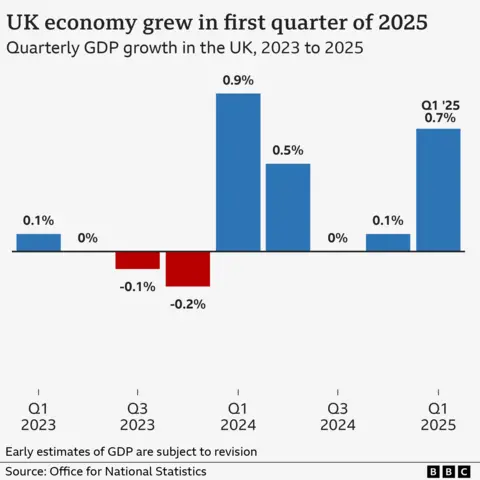

A growth rate of 0.7% beat expectations.

It is a return to normal, healthy levels of growth, at least in that quarter.

On successive governments' favourite metric - the growth of the rest of the G7 advanced economies - the UK will now be the fastest growing. This is subject to confirmation of Japan and Canada's numbers in the coming days, but they will be lower.

While almost everybody expects growth to slow in the current quarter, after months of tariff uncertainty and April's tax rises, this figure should alter the frame of thinking about the British economy.

Are millions of families still suffering from the cost of living squeeze? Yes.

Are small businesses especially in retail and hospitality under suffocating pressure from rises in employer National Insurance and the National Living Wage? Also yes.

But away from those important sectors, there is definitely resilience, and it seems even more than that.

The impact of interest rate cuts, and relative political and economic stability, may have been more much more important.

Real incomes are up, and for many businesses outside retail and hospitality, the rise in National Insurance contributions has been accommodated by a squeeze to profit margins and wage rises.

The flipside of the National Living Wage rise, is, of course, a more robust consumer amid a demographic that does spend in the shops.

The UK is a world away from the predictions of early January when widespread doom-mongering equated a rise in government borrowing rates - mainly driven by global factors - with the risk of a UK-specific mini Budget style crisis.

There are obvious challenges.

The shadow chancellor is right to say there should no champagne corks, but no bubbles were in evidence when Rachel Reeves spoke at the Rolls-Royce factory after the numbers were published.

But this number provides an opportunity for the chancellor after a growth stutter, partly self-inflicted, under this government.

A robustly growing economy, stable economic policy, falling interest rates, and a graspable positioning in the current global trade tumult as an oasis of tariff stability, are decent selling points in an uncertain world.

It is why Reeves resisted my suggestion that her welfare cuts might be negotiable after an apparent backbench revolt: "We will take forward those reforms," she said.

The chancellor may have more work, however, in convincing businesses that growth is this government's number one priority, given the prime minister's focus on an immigration crackdown.

Some interesting conversations will soon occur with businesses, for example the construction companies meant to deliver 1.5m homes, and the new infrastructure which has been planned, or merely even to staff care homes.

For now it is a relief that the British economy appears resilient and robust.

It may be temporary, but we should not assume that. These figures provide an opportune moment for some optimism and a hard sell of the UK to the rest of the world.

7 hours ago

6

7 hours ago

6

English (US) ·

English (US) ·